A US technology company set up a new company in India and used local entrepreneurs as nominal shareholders to hold shares in order to bypass foreign investment restrictions. Although the actual control was held by the US company, the Indian government found anomalies in the shareholder structure during the registration and operation process and pointed out that the arrangement violated the company law and foreign investment regulations.

The legal recognition and regulations of shareholder nominee holding vary greatly in different countries. Some countries have clear legal provisions and protection measures for nominee shareholders, while other countries may restrict or not recognize such arrangements. This usually leads to companies facing regulatory compliance risks, tax risks and shareholder rights disputes. Therefore, it is very important to understand and comply with the regulations on nominee shareholders in different countries when conducting international business or investment.

Requirements of several jurisdictions:

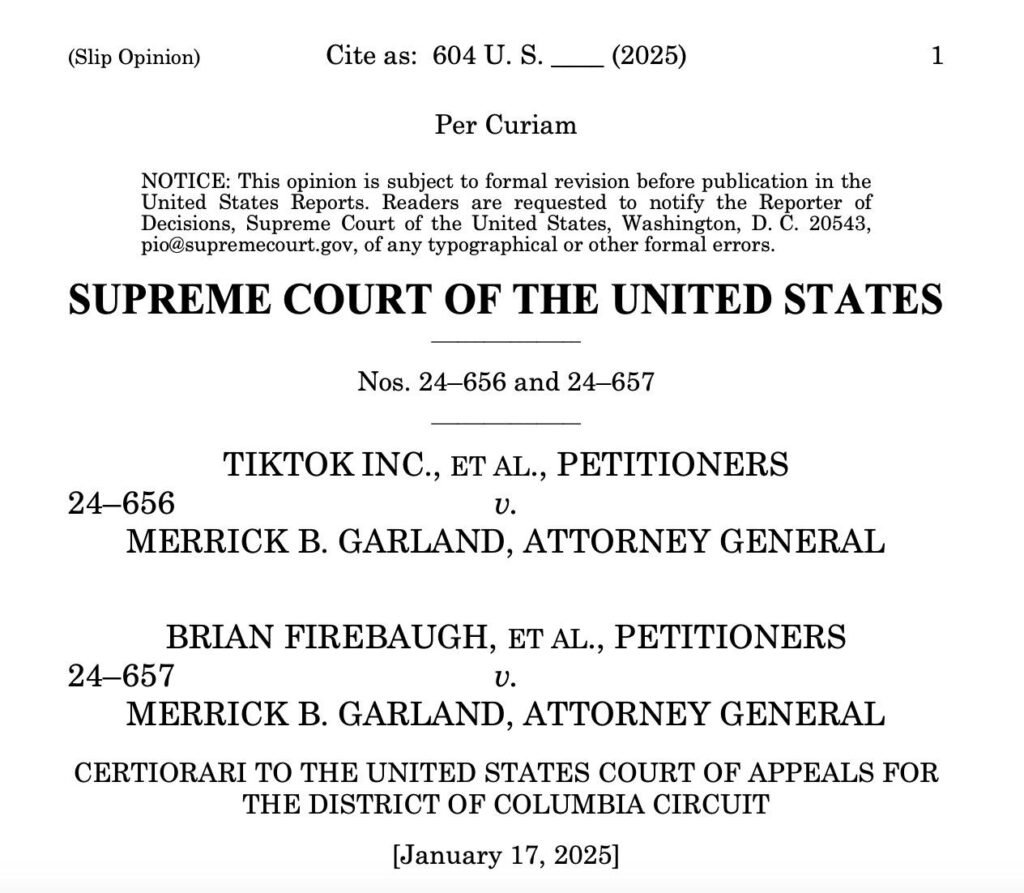

1. The United States

The United States recognizes nominee shareholder arrangements, especially in states such as Delaware that have more flexibility in corporate law. Such arrangements are mainly used for privacy protection and asset management, and many large US companies are headquartered in this state. It is important to ensure that the nominee holding agreement and trust arrangement comply with the legal requirements of each state, while complying with anti-money laundering and tax compliance regulations.

2. United Kingdom

The companies Act has clear legal provisions for nominee shareholders, allowing and regulating nominee holding arrangements. Actual shareholders can achieve nominee holding through trusts or agency agreements. However, the transparency and disclosure requirements of the Companies Act, such as the People with significant control Register, must be complied with to ensure that nominee holding arrangements do not violate anti-money laundering and transparency regulations.

3. Cayman and BVI

These offshore jurisdictions widely recognize and use nominee shareholder arrangements, mainly for asset protection and privacy management. Although these jurisdictions provide high privacy protection, they still need to comply with international anti-money laundering and tax compliance requirements, such as the Economic Substance Act.

4. UAE

The UAE does not formally recognize nominee shareholders, but they are widely used in practice. Detailed nominee holding agreements are required to protect the rights and interests of actual shareholders. It is necessary to ensure that nominee holding arrangements comply with legal and regulatory requirements, especially as there are differences between DIFC, various free trade zones and the UAE mainland.

5. India

India has stricter requirements for nominee shareholder arrangements. According to Section 89 of the Companies Act, the declaration of beneficial interest in any share must be made, otherwise a fine may be imposed. In addition to detailed legal documents and agreements, foreign shareholders also need to ensure that the nominee holding arrangement does not violate India’s foreign investment and the foreign exchange management act and regulations.