In today’s global business landscape, it is crucial for companies to navigate the complex world of taxation. The United Arab Emirates (UAE) is known for its favorable tax environment, attracting businesses from around the world. To ensure compliance with tax regulations and enjoy the benefits of doing business in the UAE, companies often seek the assistance of legal and financial professionals like Fan Zhang.

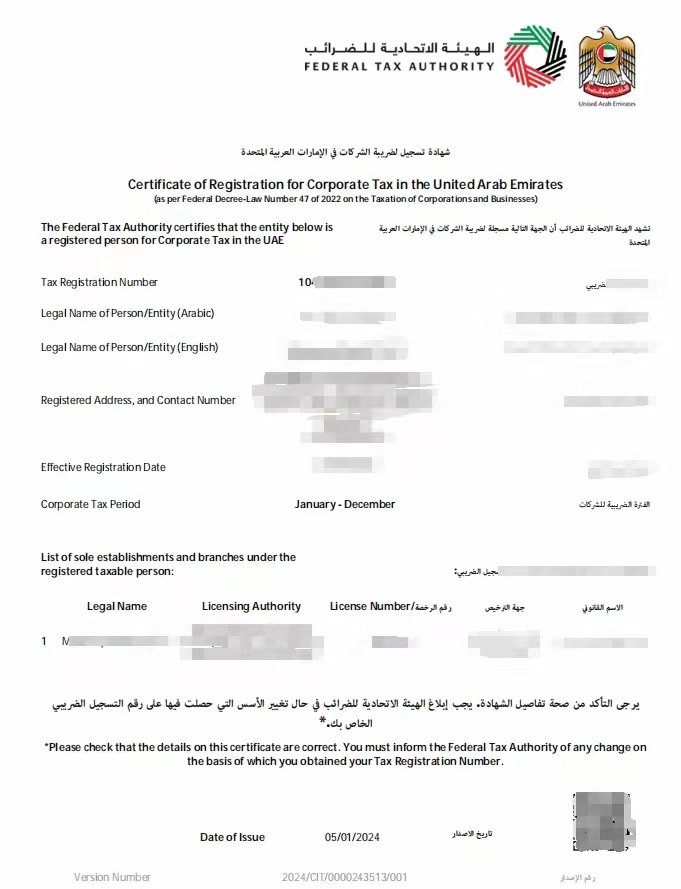

According to Article 69,Federal Decree-Law No. 47 of 2022 on the Taxation of Corporations and Businesses, this Decree-Law shall apply to Tax Periods commencing on or after Jun. 1, 2023.

This certification is a vital requirement for companies operating in the UAE, enabling them to fulfill their tax obligations and enjoy the benefits of being a registered taxpayer. The FTA is the governing body responsible for the implementation and enforcement of tax laws in the UAE. It plays a crucial role in ensuring tax compliance and maintaining a transparent tax system. Companies operating in the UAE are required to register with the FTA and obtain a Certificate of Registration for Corporate Tax.

Obtaining this certificate can be a complex and time-consuming process. It involves gathering and submitting various documents, fulfilling specific requirements, and adhering to strict deadlines. This is where Fan Zhang’s expertise comes into play. Fan Zhang works closely with UAE companies, guiding them through the entire process of obtaining the Certificate of Registration for Corporate Tax.

She stays up-to-date with the latest developments in tax legislation, ensuring that her clients receive accurate and timely advice. This knowledge is invaluable in navigating the complexities of the tax system and avoiding any potential pitfalls or penalties. She understands the unique challenges faced by UAE companies and tailors her approach to meet their specific needs. Her goal is to make the process as smooth and efficient as possible, allowing her clients to focus on their core business activities. Her knowledge of UAE tax laws, attention to detail, and commitment to exceptional service make her a trusted partner for businesses seeking tax compliance and success in the UAE.